Is this really a tipping point?

May 2024

This year has kicked off with a bang, time seemingly accelerating. Driven by a world where three non-linear accelerations are all in full flow: nature; markets, via digitisation and globalisation; and technology, with Moore’s Law having held up now for more than half a century.

This pace of change is helpful as we seek to drive change in our industry, but we should remember that change is not the same as innovation.

As we think about whether or not we are at a tipping point as it related to green building, we need to accelerate change – disruption even. It can feel unsettling and destabilising, but we need to embrace it. Perhaps most relevant in this regard is the second order derivative – your perception of the rate of change. A bit like in economics, where behaviour is influenced by inflation expectations more than it is by inflation itself. If you think a certain known fact will be stable forever, a small change in that could be disruptive. That kind of change has a greater impact than the absolute pace of change in, say, computing power, which is something we have come to expect.

Ch-ch-changes

Indeed, we find it hard to deal with the “change in the pace of change”, and we are less well-equipped to deal with it at this moment in history than we have been for a generation. We have gone through a period of trauma at a meta level with overlapping crises of pandemic, war, and in the economy, translating into personal trauma for many.

There is a large body of work around trauma; it can bring feelings of hopelessness, a resistance to change, and a thirst for stability, the exact opposite of what we in fact may need now. Change can be good – necessary even. Bringing suppressed issues to the forefront, these events have prompted a collective response and now make change more likely. Crisis situations can be catalytic events that act as tipping points.

Real estate hates change; stability has been a defining characteristic since the dawn of time. Property provides ballast in an investor’s portfolio, unwavering, reliable income with 20-year leases. Buildings stand there to welcome you day in, day out. This notion now has been overcome by the current environment, and expectations of stability – even what we want our cities and buildings to look like, and how we build them – overturned. Not least of all due to the climate crisis, adding to the post-covid reshuffling of the deck. We property folk are neck deep in change.

Diffusion of Innovations

These stressors have forced long overdue innovation in the real estate sector. But will it stick? It this finally the tipping point we have hoped for? Are we at the foothills of transformative change? Or is it just another false dawn?

Predicting when a specific change will become inevitable can be challenging, as it depends on a complex interplay of factors. The identification of a tipping point is often only clear in hindsight.

Yet, I believe we are exiting the trough of disillusionment and climbing the slope of enlightenment.

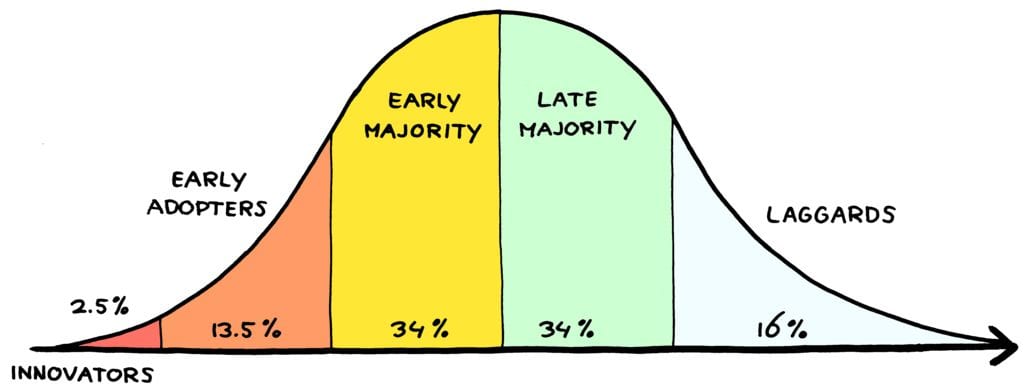

A handy social construct about change comes from Everett Rogers’ 1962 Diffusion of Innovations theory. His book explores how new ideas, technologies and cultural norms gain momentum, spread, and are adopted. According to Rogers, for transformation to stick, the new idea needs to be seen as objectively better, fitting our needs, easy to implement and test, and provide results.

If we think about the innovation needed to drive greater sustainability and social impact in real estate, I believe all of these factors are now prevalent in spades.

Consensus seems to be that tipping points live somewhere between 10% to 25% adoption, depending upon the innovation, before it spreads to the entire population. The point at which the early adopters and the early majority come together and create a domino effect that propels an innovation into mainstream acceptance.

Where is the property sector on the chart above? Certainly well into the early adopters and perhaps breaking into the early majority. A tipping point.

What the second half of 2024 holds

This tipping point is manifesting itself in all sorts of ways. In the The Building Breakthrough commitment launched at COP28, the adoption of low-carbon and resilient buildings was described as the “new normal”. With a 2030 target to get half way to to net zero, we are nearing wholesale acceptance that from now on we can only build buildings to a net-zero standard.

We are also seeing that retrofit and reuse are becoming the norm. The City of London approved a record number of retrofit planning applications in the Square Mile in 2023 and is now pressing ahead with its retrofit-first policy. Westminster has introduced a tax of £880 per ton on embodied carbon.

To aid this, I hope that in 2024 that reporting of embodied and operational carbon – two simple numbers – will become ubiquitous.

I also believe in 2024 we will stop talking about social value and focus on social impact. Every building, on every street, will be recognised for its potential to be a factory of improved social outcomes. This will be the year that these and other things tip from the realm of the special case into the realm of the everyday.

Finding a balance between stability and change is crucial for long-term wellbeing on every level – personally, professionally and politically. But history is replete with examples of tipping points, both technological and social, that worked out just fine. The printing press, electrification, the internet, civil rights. Perhaps this is one of those moments. And it is the time for change.

A version of this article originally appeared in Estates Gazette.